Cash management for small businesses

Date posted: 17.04.2014 | Author: Harry BovensmannThe last thing small business owners want over any holiday period is a cash management crisis that could result in financial harm to the business and pain for staff and or customers.

Referring to the upcoming Easter and holidays in May, Ravi Govender, Head of Small Enterprises at Standard Bank, said an effective cash management plan could mitigate against potential risks at a time when increased spending by consumers is likely to result in higher turnover.

Cash management is the way that a company handles all aspects of the financial end of the business, like collection of revenues and investing of cash and other assets. This is necessary for a company to stay afloat and solvent. Although cash by definition refers only to paper or coin money, in cash management, companies usually also work with cash equivalents. By using electronic methods, the money system becomes more abstract.

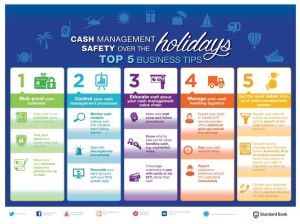

The top five business tips for managing cash flow and playing it safe over the holiday period:

- Safeguard your business against risk;

- Stay informed about your cash management processes;

- Educate your staff about your cash management value chain;

- Manage your cash handling logistics; and

- Extract the most value from your cash management system.

[click on image for enlargement]

- 5 tips for cash management (Standard Bank)